In principle, football results are randomly distributed but the outcomes of games can be predicted fairly accurately using statistical modelling.

This is contrary to other forms of gambling loaded in favour of the house such as lottery and roulette, where success tends to rely more on luck than strategy.

Image: PhotoSky (Shutterstock)

Image: PhotoSky (Shutterstock)With football betting, there are only three possible half-time and full-time outcomes (home/draw/away) for example, and sometimes just two sides to a football bet (e.g. over/under ‘X’ goals).

In contrast, the UK National Lottery has 45 numbers providing over 14 million combinations of the six needed for a jackpot, meaning the chances of winning are drastically low.

Similarities of Professional Football Betting and Stock Market

Indeed, football betting is a little like stock market shares where it is possible to select profitable investments, and traders can forecast with a deal of accuracy whether prices are more likely to rise or fall.

Whereas in stock markets prices sometimes rise or fall unexpectedly, freak results also happen in football as every fan will have observed.

I was fortunate enough to receive tutoring on financial and quantitative analysis of stock markets at university but of course, football betting is not on the syllabus. However, the more I study betting and its underlying statistics, the more parallels I can draw with stock market analysis.

The secret of long-term financial success in the stock market is not necessarily always about buying the right shares or options.

Obviously, a good selection of instruments naturally influences the profit margin in a positive manner but, long-term financial success is not guaranteed if the portfolio is wrongly structured. The same applies to football betting.

A professional stock broker would not dream of investing all of his clients’ money in just one share or option. Indices such as DAX, MDAX and TecDAX all include at least 30 companies in their portfolios. The DAX 100, as its name suggests, contains 100 companies.

Why, therefore, does the stock broker look to invest in a wide range of markets? The answer is obvious: This is done to reduce or spread the risk if one or another share price develops in the wrong direction. And, even in the very unlikely event that the whole stock market collapses, the indices will never totally drop to zero.

Translated into gambling, these principles indicate that you should never ever put all your bank on one individual bet, however ‘sure’ it appears. You must always bet on (invest in) a portfolio of events in order to spread the risk/investment for long-term returns.

What Exactly is a Portfolio?

One interpretation reads: …”A bundle of investments in the possession of an institution or an individual… Usually, an extensive analysis precedes the structuring of a portfolio… A portfolio is typically part of the strategy to reduce the risks of financial investments by diversifying”…

Translated into betting language:

…”A portfolio is a package of bets where extensive analysis has determined the choices (picks)…This is an essential part of the whole betting strategy in order to reduce the risks of losing by diversifying”…

Portfolio Betting Example

This is an example of my portfolio of bets for 26.2.2011:

Laying a considerably weaker away team (in terms of odds):

- English Premier League: Aston Villa vs. Blackburn Rovers – Lay Away (5.3)

- English Premier League: Wolverhampton Wanderers vs. Blackpool – Lay Away (4.8)

Backing at odds between 3.35 and 3.5:

- English Premier League: Wigan Athletic vs. Manchester United – Back Over 3.5 Goals (3.35)

- English Championship: Hull City vs. Cardiff City – Back Draw (3.5)

Laying the Draw:

- English Championship: Barnsley vs. Norwich City – Lay Draw (3.4)

Laying the home team in games between equally matched teams (in terms of odds):

- English Championship: Doncaster Rovers vs. Watford – Lay Home (2.84)

- English Championship: Middlesbrough vs. QPR – Lay Home (2.88)

- English Championship: Millwall vs. Nottingham Forest – Lay Home (2.62)

I carried out an extensive statistical analysis before picking these games as my ‘value bet portfolio’ for the weekend and happily, seven out of eight bets (87.5%) won.

My calculations also revealed that had only five (62.5%) won, the profit would still have been in excess of 10%. If only 50% of the bets had been successful, the financial loss would have been limited to 10% of the bank.

Probabilities

The calculated probability that all eight of the selected picks lost was minimal at 0.0026% (38,428 to 1). The probability that all eight picks won was 3.53% (28 to 1).

The probability that seven or eight of the eight picks won was 20.77% (4.8 to 1).

In layman’s terms this means that assuming my trend analyses and calculations of the probabilities were correct (of course, there is always the possibility of calculation errors), statistically speaking with this type of portfolio structure, every 27th weekend is likely to produce eight out of eight winning picks, and on average, every 5th weekend is likely to finish with seven out of eight correct picks.

Based on my own statistical calculations for each event, the individual probabilities equated to:

- Aston Villa vs. Blackburn Rovers – Lay Away (84.69% probability of Blackburn not winning)

- Wolverhampton Wanderers vs. Blackpool – Lay Away (84.69% probability of Blackpool not winning)

- Wigan Athletic vs. Manchester United – Back Over 3.5 Goals (38.24% chance of happening)

- Hull City vs. Cardiff City – Back Draw (37.27% chance of happening)

- Barnsley vs. Norwich City – Lay Draw (81.07% chance the match is not drawn)

- Doncaster Rovers vs. Watford – Lay Home (75.28% probability of Doncaster not winning)

- Middlesbrough vs. QPR – Lay Home (75.28% probability of Middlesbrough not winning)

- Millwall vs. Nottingham Forest – Lay Home (75.28% probability of Millwall not winning)

If you multiply all the probabilities, 84.69% x 82.69% x 38.24%, et cetera, the result is 3.53%. This was the calculated probability that all eight of the chosen independent events would occur (i.e. all eight bets win).

The opposite is of course to multiply the probabilities of the selected bets not winning: 15.31% (1 minus 84.69%) x 15.31% (1 minus 84.69%) x 61.76% (1 minus 38.24%), et cetera, for a result of 0.0026%. This was the probability of all eight bets losing.

Roughly speaking, the chance of winning all eight selected bets was 1,350 times higher than losing all eight of them (38,428 divided by 28 or alternatively, 3.53% divided by 0.0026%).

In this fashion, you can compute all the other probabilities for each permutation of events to structure the portfolio and organise its staking. However, an exact explanation of probability calculation and portfolio diversification would complicate this article just now.

If you would like further depth on this topic, then please read my articles on combinatorics and probability and also on probability and deviation, both of which offer a more advanced approach to the thinking needed before composing structured betting portfolios.

Please post any questions or comments in the Leave a Reply box below.

Hi Audiendi,

A spread of risk is vital to the success of any betting portfolio.

We’ve said it so many times throughout this blog that betting continually on low priced favourites only, without value on your side, is a road to ruin.

Have a look at the 2016 Summer League Campaign free Excel workbook download. In the Inflection Points tab, you’ll see that it was a zero sum game betting on anything up to odds of 2.28 (even with value on our side), but it was the mixture of these favourites, plus draws and underdogs that created the handsome profits.

Bookmakers make their money out of people who are scared of lower probability bets. This is the reason why most favourites are under-priced – purely because most bets are placed on these outcomes.

Successful betting is all about a certain mindset. It calls for being methodical, mechanical and unemotional. Once you have these qualities you will actually prefer to bet on the bigger odds, because that is where the money is. The smaller odds just fill in the naturally larger gaps of the losing streaks in the smaller probability bets.

As for the example in this article, the bets were prompted by nothing more than having some balance to the portfolio. Yes, there was value in every bet (at least 10%). Finally, there is no need to balance the risks by weighting stakes. In fact, you actually nullify the effect of a large portfolio of different probability bets if you begin to apportion different stakes to them.

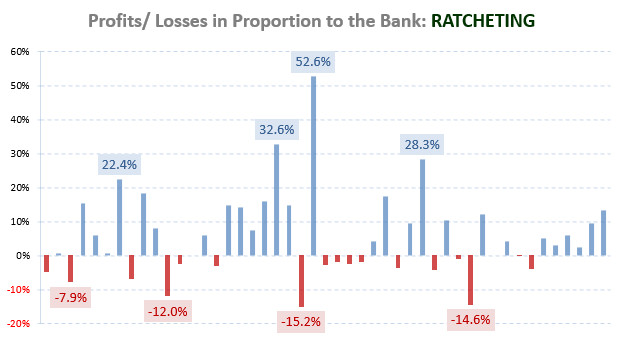

It is always better to flat stake everything, with a ratchet system in place to increase all stakes once bank targets are met. You should also protect the back door with a stop loss mechanism to reduce stakes uniformly should the bank drop to certain specified levels of your choosing.

Hope this helps and thanks for the questions!

Hey Soccerwidow,

Terrific job. I notice that you had a very high probability of success with six of the bets (at least according to your calculations). I’m interested in getting into betting but I hope always to be quite conservative for fear of losing control. So the relatively conservative bets appeal to me.

What worries me a bit is the two bets which your calculations suggested had 37% and 38% chances of success, respectively.

May I ask what prompted these bets? Did you detect excessive amounts of value in them? And did you balance the risk by staking less than you would have staked on the bets with lower odds?

I agree that a portfolio strategy is a very good way to bet.

The best way to use a portfolio in betting imo is in ante post betting.

i want to be come a good forecaster how will you help me on it

Thank you

Learn odds calculation…

True Odds & Value Detector: League Games with H2H History: https://www.soccerwidow.com/betting-maths/true-odds-value-detector-league-games-h2h-history/

Soccerwidow’s Football Betting Course – How to Calculate Odds: Betting on Over / Under ‘X’ Goals: https://www.soccerwidow.com/betting-maths/tutorial/soccerwidow-betting-course-betting-on-underover-x-goals/