I have always preached that there is no way to make money in the long run from betting without having a strict staking plan in place.

But which staking plan is the best?

The answer is: A simple and straightforward staking plan. Nothing complicated; just plump for flat staking with or without a ratcheting mechanism.

All other staking plans contain one or another problem and I can guarantee that there is definitely not a single staking method in existence, which makes a failing betting system work.

Therefore, firstly work out a sound betting system and then secondly, adhere to a modest and plain staking plan. Keep the money management as simple as possible because it is already difficult enough to keep up with everything that goes into monitoring a betting system. You will perhaps also have to think about juggling your bank between various bookmakers and exchanges if needs be.

In today’s article I’m going to show you a fuss-free staking plan using the example of our 2017-18 Winter League portfolio .

As mentioned, it’s a combination of a flat staking plan and a ratcheting mechanism.

A Definite Edge and a Sound Staking Plan Work Wonders!

With the help of our HDAFU Tables and, in particular, their Inflection Point graphs, it is now easy to develop a portfolio of bets with a definite mathematical edge.

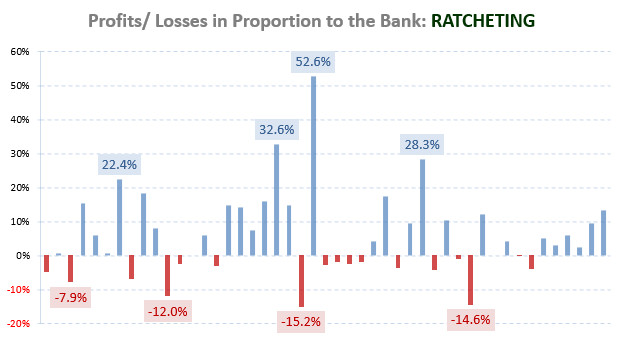

And in conjunction with our chosen staking plan, the portfolio of 2017-18 Winter Leagues performed as follows:

Image 1: 2017-18 Winter League Campaign – Profit Curve with Ratcheting

Image 1: 2017-18 Winter League Campaign – Profit Curve with RatchetingWe started with a betting bank of 4,000 units and finished after 47 weeks and 518 bets with a total 38,925 units.

Of course, it wasn’t a smooth ride the whole time. Especially at the start of the season, the first 15 weeks (up to 27/10/2017) were very tough. 153 bets were placed but the result was pretty much a zero sum game. It did eventually rise to 5,562, but for all the time invested and work performed it was quite a frustrating experience.

From this point until the end of December, results were better and the ratcheting system helped the bank up to 13,792 units. But then another rough period started.

Nevertheless, it was worth it! A very long slog (47 weeks!) for a profit of 34,925 units. A great result vindicating the soundness of both the portfolio of bets and its staking plan.

Just as a side note, if you want to learn more about how the portfolio was originally compiled and how it performed in detail then you will find our report here: System Football Betting: 2017-18 Winter League Report – 35k in 138 Days

But let’s get back to the topic of the article: proper staking…

Image 1 showed you the performance of the portfolio using ratcheting, but if we would have applied a flat staking plan only (without ratcheting), then the Profit/Loss curve would have looked like this:

Image 2: 2017-18 Winter League Campaign – Profit Curve Flat Stakes

Image 2: 2017-18 Winter League Campaign – Profit Curve Flat StakesYou can see straight away that the simple flat stakes (without ratcheting) also produces profits, but the curve is much flatter – here, the betting bank only increases from 4,000 units to 13,909 units. Flat staking lacks the exponential element of a ratcheting system to grow a bank, but on the other hand, it is much easier on the nerves as I will show you later in this article.

But first here are a few definitions…

What is Flat Staking?

Flat staking simply means that you wager on every bet exactly the same amount of money, without any deviations. But this may include some consideration towards the risk of each bet. You may therefore wish to stagger your stakes according to the implied probability (odds) of winning each bet:

- VERY SIMPLE: decide to stake a flat 100 units on every bet in the portfolio.

- SIMPLE: decide to stake a flat 100 units on bets with odds below 1.50, 50 units on bets with odds between 1.50 and 2.50, and so on.

But whichever of the two options you choose, you are in effect still ‘flat staking’.

What is Ratcheting?

Ratcheting is a progressive money management approach where the size of the stakes move by degrees, upward or downward, depending upon results.

(A) If your portfolio wins, increase the stakes!

With ratcheting the stakes are variable and depend on the size of the bank. However, the percentage of the ratchet (in our case 2.5%) always remains constant.

If at the end of a round of matches (or week) your bank has grown, all bets placed the following week should be adjusted to the higher bank.

For example, if the bank increases from 4,000 to 4,500, the stake increases from a flat 100 units to 112.50 per bet in the following round (i.e. stake remains at the base level set of 2.5% of bank).

The percentage of the bank used per bet stays ‘flat’.

(B) If your portfolio loses, reduce the stakes!

Nevertheless, you also need to guard against bankruptcy. If your portfolio experiences a losing round, reduce the stakes for each bet but not before the bank drops to 75% (or below) of its highest point.

You may think that this method is simply a stop-loss strategy, but it isn’t quite the same. I will explain further down in the article why we used 75% as the margin for our downwards ratcheting and not any other number.

Should you lose at the end of a round (week), continue to play each bet with the same, unchanged stake until the bank’s previous high has shrunk by 25%.

This means that in the event of a short-term loss, the stake continues to refer to the bank at the highest level it has reached so far and does not adjust to the lower bank until the bank has dropped to 75% of its peak size.

Only then is the stake recalculated (reduced) and the ratchet process begins again.

To be clear on this point, in the event of a run of losses, the stake size per bet always remains in relation to the highest bank to date and should not decrease until the threshold of 75% of highest bank ever is reached. (If you have for example, a very bad start to a campaign, the 75% trigger point may well apply to your starting bank).

Only then will the stakes be adjusted (reduced) to this lower bank size. This will then be your new starting bank. All further bets from then on refer to this bank and the ratcheting process begins again.

Example 1:

The bank drops from 4,000 to 3,800: The stakes remain unchanged, flat 100.00 (= 2.5% of the starting bank of 4,000) for the next period (round/ week).

After the next round the bank closes with 3,520. Still, the stakes remain unchanged, flat 100.00, using the previous bank of 4,000 for its calculations.

Only if the bank closes with under 3,000 (75% of 4,000) will the stake sizes be recalculated.

Example 2:

Using the starting bank from our previous example, the bank has dropped to 2,800. This has now become the new starting bank and the stake is recalculated:

2,800 x 2.5% = 70.00

With the reduction of over 75% of the bank from its former highest level of 4,000 (100 unit stakes) to 2,800, the stake size is recalibrated and remains flat at 70 units.

Afterwards, if the bank starts to rise, you will need to begin increasing the stakes again.

Say, after the next round you bank has gone up to 3,150.

3,150 x 2.5% = 78.75

The adjusted ‘new’ stake is now 78.75 and remains in place until either the bank drops to 75% of 3,150 (2,362) or the bank grows above 3,150, when stake amounts will be 2.5% of the new, larger bank size.

Flat Staking vs. Ratcheting

We have seen that ratcheting is purely a method of ‘flexible flat staking’ to encourage exponential bank growth.

The idea is to start off with stakes of 100 units and, if everything goes according to plan, by the end of the season the stake sizes should hopefully be in the multiples of 100 units.

Looking at the other side of the coin, the losses during this time will be in the same proportions, and not everyone is comfortable when losing a few thousand units in an afternoon, even if its ‘just winnings’ from previous rounds.

Bear this in mind before you decide to try ratcheting. Are you a disciplined person? Are you able to function when you have a few thousand riding on a few matches?

If your answer to these questions is ‘no’, then please do yourself a favour and stick to flat staking only! Do not try ratcheting, at least not to the end, and stop increasing your stakes when you reach the limits of your comfort zone (or have achieved target).

Get our 2017-18 Winter League Campaign Report

You may find it helpful to follow the explanations in this article with the help of our dedicated Excel workbook detailing our 2017-18 Winter League portfolio. Not only does it contain the match data and calculates the flat and ratchet staking results, but it also shows how the portfolio was composed and provides many other useful snippets of information.

We are sure that you will feel the nominal £5.00 GBP charge is a real bargain.

The size of this .XLSX Excel file is 568KB:

>>> 2017-18 winter league campaign <<<

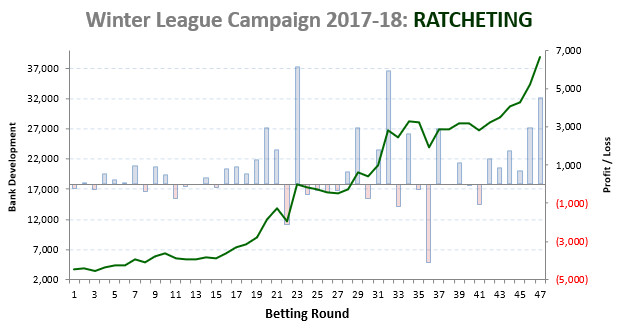

Bank Development during Rough Periods

Even the soundest portfolio of bets will experience bad periods where one bet after another (or even one round after another) is losing. It happened to us from the 09/12/2017 (2017 week 50) – 11/03/2018 (2018 week 11). Three months of more losing rounds than winning ones! Tough indeed!

Here are two images that show the profits/losses together with the bank development during this rough period using flat stakes versus ratcheting:

Image 3: 2017-18 Winter League Campaign – Using Flat Stakes only

Image 3: 2017-18 Winter League Campaign – Using Flat Stakes only Image 4: 2017-18 Winter League Campaign – Ratcheting the Stakes

Image 4: 2017-18 Winter League Campaign – Ratcheting the StakesBoth staking plans produced profits but, to put the choppy ride into even better perspective, you will need to note that the results summarised in Image 4 were by this time already based on a ratcheted bet size of 344.80 units (as at 09/12/2017), and this has grown to 707.82 units by 11/03/2018.

The period spanned more than 15 weeks with nine losing rounds (60%). From the 23/12/2017 – 12/01/2018 there were many losses, not huge, but enough to be nerve-racking!

The biggest losing round of bets with flat staking was: – 578

The biggest losing round of bets with ratcheting was: – 4,091

Tough! This again highlights the difference in volatility between flat staking and ratcheting. Steel hearts only required here!

However:

The biggest profit round with flat staking was: 1,785

The biggest profit round with ratcheting was: 6,155

Great! But please don’t get carried away too much!

Moral #1: If you are a person that finds it challenging to keep emotions under control, stick to flat stakes! The best laid plans fall to pieces if you can’t cope during the really rough times.

It is always better to be a modest winner than a brave loser.

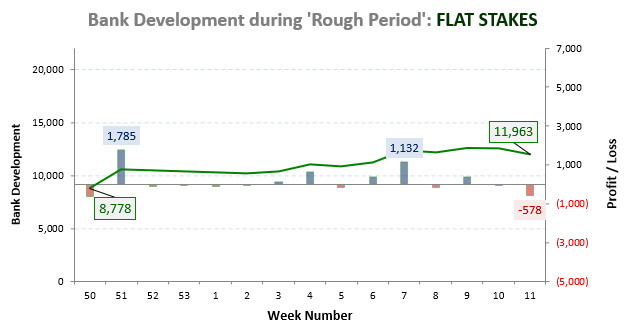

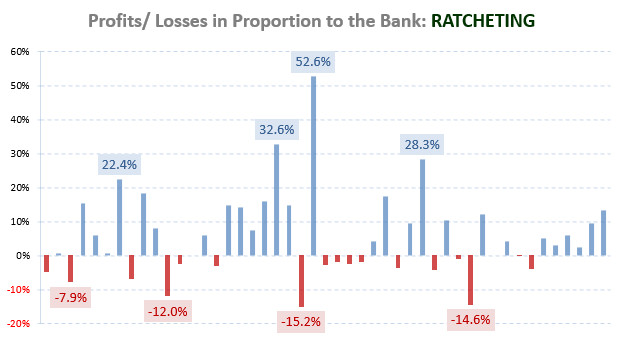

Emotional Rollercoaster when Winning or Losing

In the previous section you saw the monetary effects of winning and losing when using flat stakes only or when ratcheting. However, the differences become even more obvious if you look at the profits/losses in relation to the bank:

Image 5: 2017-18 Winter League Campaign – Profit/Losses in relation to the bank: Flat Stakes

Image 5: 2017-18 Winter League Campaign – Profit/Losses in relation to the bank: Flat StakesWhen staking flat our example portfolio only produced a maximum loss of – 8.1 % of the bank. The winnings too were pretty ‘modest’: a maximum of 20.7%.

Ratcheting involves a far greater rollercoaster. The maximum loss was as high as – 15.2 % of the bank. The maximum winnings were: 52.6%.

Image 6: 2017-18 Winter League Campaign – Profit/Losses in relation to the bank: Ratcheting

Image 6: 2017-18 Winter League Campaign – Profit/Losses in relation to the bank: RatchetingMoral #2: As I have already said, simple flat stakes (without ratcheting) are much easier on the nerves than ratcheting. The exponential growth a ratcheting system produces goes hand-in hand with exponential losses.

Stop-Loss Margin when Ratcheting

In the article Bank Management & Stake Size I explained the ‘scientific’ calculation of the percentage of starting bank that should be used for betting.

It was based on the average of the three largest losing rounds (weeks):

12%, 15.2% and 14.6% >>> average: 13.9% (rounded: 14%).

We can use this figure of 14% to calculate the stop-loss margin. You see, everything is somehow connected. The stake size, the stop-loss margin, and much more.

To be able to sit through a run of at least two losing rounds in a row where the bank is depleted by 14% each time you need to calculate as follows:

86% x 86% = 73.96%

Let’s round this up to 75% to be more risk averse (safety conscious).

Hence, if your portfolio loses, reduce the stakes but not before the bank drops to 75%. It is very unlikely to happen but it may, you never know. By the way, our bank didn’t drop a single time below the 75% threshold during the Winter League 2017-18 Campaign.

Please bear in mind that all the calculations and explanations are based on a portfolio of just over 500 bets with an expected hit rate of around 50%. Should your portfolio be different (no two are alike), then you will need to carry out all the calculations using your own figures.

If you cannot calculate this for yourself in such great detail then either stick to the 75% threshold, or perhaps lower it to 65% (if you have a lower risk aversion) as advised in previous articles.

Moral #3: Better to be safe than sorry. If you are new to ratcheting it’s probably better if you play with smaller stakes than the calculations actually permit (e.g. 1.5% of your betting bank instead of 2.5%) then you won’t reach the stop-loss margin too quickly.

I hope you’ve enjoyed this article and learned something about sound staking and ratcheting. However, if you are still unsure on any point, please feel free to ask any questions via the comment section below.

“If you cannot calculate this for yourself in such great detail then either stick to the 75% threshold, or perhaps lower it to 65% (if you have a lower risk aversion) as advised in previous articles.”

I’m quite curious how setting a lower threshold for the stop-loss would indicate lower risk aversion. Shouldn’t a higher stop-loss minimize a further streak of losses on the way down?

Perhaps it’d be good to link to the previous articles that were referenced as well. I can’t seem to find one which mentions the ratcheting stop-loss.

Thanks.

That totally makes sense and for what is worth since i bought your O/U course i have indeed learned a lot and actually spent time in excel working with formulas so i think i could replace the numbers with formulas if i tried.

I do have a few question about the formula in “Y10” cell under system performance if it’s possible to get some insight.

In the first nested AND function It states that if the odds available when placing bets are smaller or equal K10*Z6 (which always equals 0), why does it also check if the expected hit rate is bigger then 50%. Since the first part of function is only “TRUE” if the odds when placing bets are 0 or less why would we then even need to check if expected hit rate > 50%?

Second question is why are we using exactly 50% in Y5 to compare it with expected hit rate. Also in the second AND function is there a specific reason 85% is selected to multiply zero odds with?

The first AND formula…

$K10*$Z$6

$K10: Zero Odds

$Z$6: set to 0% (you can put any number in Z6)

$J10>$Y$5

J$10: expected hit rate

$Y$5: currently set to 50% (you can put any number in Z6)

The formula means… bet on everything, even if the odds are far the expected Zero odds as long as the expected hit rate is above 50%

The second AND in the formula you can now probably work out yourself… 😉

Hi,

just curious if the staking tab in the Winter League Campaign Report is missing formulas for flat stakes & ratcheting intentionally?

Hi Gasper,

yes, we removed the formulas intentionally. It’s a monitoring not a formulas-give-away spreadsheet. The opening, closing and mid-time odds that the spreadsheet contains are already priceless information as well as giving away the systems we used.

You at least bought our Over/Under course at some time in the past. Thank you very much for supporting Soccerwidow! And I truly hope that you learned a lot from the course. 🙂 However, we have countless readers who don’t buy anything, enjoy reading our website and get all the information for free. Therefore, please accept my apologies that there are no formulas contained in the workbook if it wasn’t necessary to make the workbook to work.

hi, so ive been only using a 2% of my bank system for quite some time now, adjusting it daily to increasing and decreasing money. Most annoying thing being to lose high stakes after a winning period. The 75% margin prevents this. Will probably try it out. Would you personally see any advantages/disadvantages in increasing the stakes (if money is won) daily instead of each week?

Wouldnt the bank grow faster? Since a profitable monday would already lead to an increased tuesday and so on, but you probably couldnt lose as much on a monday that you would need to decrease already. And since winning and losing days are not predictable i dont see a reason not do it. Or do you think its more risky for some reason?

Hi Matt, you can do it daily if you like or biweekly, say Fridays for the weekend games and Mondays for the week days. The choice is yours.

Just do an analysis of your previous years’ bets how it would have performed for those different variations and then go for the most promising as well as the most nerve-saving option.

It would be great to see what the winter portfolio results would of been if the ratchet system was done on a daily basis rather than a round basis? Excellent content as always and looking forward to more portfolio reports in the future

I read your article on Maria’s staking plan and wondered if something similar would help smooth out the roller coaster ride of the ratcheted stakes. So one would still use say 2.5% of the bank as the basis of your staking but them increase or reduce that in line with the probabilities implied by the hit rate of a particular system.

Hi Bruce,

in the example portfolio I showed in this article, following staking smoothed it out:

Up to 30% probability: 1.5%

Up to 40% probability: 2.0%

Up to 50% probability: 2.5%

Over 50% probability: 3.5%

Please note that the calculations need to be done individually depending on the size of the portfolio as well as the exact compilation. Problem is that this requires a whole course to explain it properly, this is why I didn’t even mention it in the article.

Your suggestion to split the stakes, e.g. into home wins in Greece and for the draws in the EPL, etc. probably won’t work. I would always make it either dependent on the odds played or on the expected hit rate (probability) of the system.

Thanks for the reply. I used the examples of Home wins in Greece and draws in the EPL because those systems had different expected hit rates – so I think we’re on the same page there.

I can quite imagine that the whole thing gets complicated – my own plan is to calculate, using the predicted hit rate, the longest losing run of each system in my portfolio. I then plan to size my bets so should such a run occur in any of the systems its affect on the bank would be the same. So a system where the calculated LLS is 5 would have a bet size twice that of a system where the calculated LLS is 10. I think that actually ends up pretty close to the numbers you’ve suggested above. Did that smoothing have much effect on overall profitability? Personally I like smooth and will sacrifice some profit for an easier ride.

This is sort of an experiment and so the starting stakes are pretty small – I’ve got your report from last season so I could play around and try and fine tune things but the season is upon us.

PS – sorry about the double posting but my post seemed not to be showing up so I wrote another.

The portfolio with flat stakes only produced 38,925; the one with ‘smoothing’ 41,327. The difference is insignificant to say that ‘smoothing’ leads to much better results.

You cannot even say that the portfolio with fixed staked produced regularly higher losses than the one with flexible stakes. They are both pretty equal although the ‘smoothing’ stakes are probably (slightly) easier on the nerves. The problem is that you simply don’t know when the losing streaks occur and LLS 5 may happen at the same time as LLS 10.

Thanks for the reply – I’m actually surprised that the ‘smoothed’ version led to a higher profit – although you note this may not be significant.

I agree that such a staking plan has problems – reading your report on the last season almost no leagues performed in line with expectations – so a staking plan based on those expectations seems flawed – but then if no leagues perform as per expectations one might say the whole concept of looking at past performance is flawed but your results suggest otherwise.

I shall experiment with reasonably small stakes and see where I end up.

Hi Bruce,

the statement that ‘no leagues performed to expectations’ means that no league exactly hit the goal.

Say, the average height of a population is 1,75m and you go out and measure the first 50 you come across. Do you really think that your result will be exactly 1,75m average height? It probably won’t and you too would make the statement that the result ‘didn’t exactly meet the expectations’. But if you would do it with 10 different groups then you will probably get pretty close to 1,75 when you look at these 10 groups together as a whole. That’s then the ‘portfolio effect’.

Hope that example makes sense.

I’ve read your post on Maria’s staking plan – would using this in conjunction with the ratchet smooth the roller coaster somewhat – so your base stake would still be 2.5% your bank with this being adjusted according to the risk implied by the hit rate of a particular group of bets in the portfolio – so for the Home wins in Greece you’d stake more and for the draws in the EPL you’d stake less etc.