This article moves away from betting on individual teams, and pushes strategic thinking further up the knowledge ladder.

The method described below explains how to use our HDA simulation tables for recognising profitable 1×2 betting strategies and building a portfolio from a selection of major European leagues.

Profitable betting on football is about compiling successful portfolios and understanding the underlying market economics.

The following analysis portrays just one successful scheme in detail – Have fun learning about market behaviour and deriving a betting system from it! 🙂

Understanding the Betting Market

It is impossible to predict with total accuracy the outcome of one particular match; however, it is possible to identify and use historical distributions of data to judge the future in general.

If you do not know what the term ‘distribution’ means, check out this article for an introduction:

Goal Distribution Comparison – EPL, Bundesliga, Ligue 1, Eredivisie

However, understanding distributions, odds calculation and probabilities is only the first step.

The next step is to understand the market economics. Just in case you missed them here are two articles describing how the bookmaker market works:-

How do Bookmakers Tick? How & Why do They Set Their Odds as They do?

How Bookmakers’ Odds Match Public Opinion

The main message of these two articles:

- Bookmakers set odds based on a mixture of statistical probabilities and public opinion. Effectively, their odds match public opinion.

- Bookmakers do not speculate (gamble). Their priority is balancing the books.

Comprehending Market Economics to Elect a Strategy to Investigate Further

Remember your basic economics lessons in school or college which were about supply and demand.

Adapt this to the football betting market: In which situations will bookmakers reduce their prices (odds), and which prices will increase as a result? Which bets are traditionally the most popular?

The fact is the majority of punters prefer betting on favourites up to odds of 2.5. Just look at online odds comparison sites which show the percentage distribution of bets on a certain outcome. It is frequently above 60% on the favourite (independent from the offered odds), if not higher.

On the other hand, consumer demand for bets on the underdog is often much lower than the actual chance of it winning.

Bookmakers are aware of this market behaviour and try their best to predict trends, time the market, and choose the best outlets for their odds. Customer behaviour is well analysed and used to generate various marketing strategies aimed at balancing the books and boosting sales.

Therefore, for the bettor, it is safe to assume that many favourites will be under-priced to win, and draws and/or away wins will be over-priced to “make up and balance the book”.

For example, a traditionally strong team like Bayern Munich playing away will, of course, attract a good deal of punters betting on them to win rather than any weaker opponent playing at home. However, most punters are normally ignorant of the fact that even teams such as the mighty Bayern Munich win approximately just 50% of their away games.

In these game constellations bookmakers, simply by following market economics, have to reduce their prices for the (away) favourites massively and balance this by increasing the price of the less fancied home team.

Investigating Distributions: Profit/Loss Inflection Points

From what has been explained in the previous chapter it should now be obvious that favourites are often under-priced to win, and draws and/or away are frequently over-priced. Therefore, it should be possible to find a workable strategy using this knowledge.

Now comes some maths… hang in there! 🙂

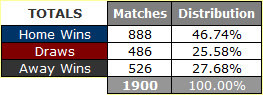

In the last five seasons, a total of 1,900 matches were played in the English Premier League (EPL), of which, 46.74% finished in a home win:

EPL: Full-time 1×2 distribution – Five seasons 2009-14

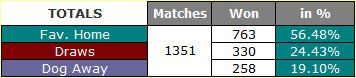

EPL: Full-time 1×2 distribution – Five seasons 2009-14The home team was priced the favourite in 1,351 of these matches (home odds lower than the away odds), and a total of 763 games did indeed end in a home win, equating to 56.48%.

EPL: Favourite home wins – Five seasons 2009-14

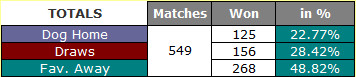

EPL: Favourite home wins – Five seasons 2009-14The balance of 549 matches saw the home team priced as the underdog (home odds higher than the away odds). From these games, 125 finished in a home win for the underdog, equating to 22.77%.

EPL: Underdog home wins – Five seasons 2009-14

EPL: Underdog home wins – Five seasons 2009-14Now convert these favourite and underdog win percentages into odds:

Home wins (Favourite): 56.48% = 1.77 [European odds]

Home wins (Underdog): 22.77% = 4.40 [European odds]

The above two odds are “inflection points”, the points on a curve at which the curvature or concavity changes from plus to minus or, from minus to plus. Translated into layman’s language… the pivot points along the profit/loss curve where profits turn to losses or, where losses turn to profits.

However, these are purely the mathematical inflection points and do not take market forces into consideration.

Therefore, please do not start betting on every favourite at home priced below 1.77 in the EPL, or on every underdog playing at home priced above 4.40. (Although following this simple strategy would have produced quite a profit!).

Hi. Fascinating website. I’m very interested in purchasing a 1×2 table. Which leagues prove to be the most profitable, year in year out?

Hi Gary, there is no league which stands out to be more profitable than the other. They all have different inflection points (meaning different profitable odds clusters).

What you are looking for, is a portfolio of different leagues in order to spread the risk and to increase the number of bets for one betting round.

Whatever system you choose, for a betting round you may find 2 matches in one league which fit, and only 1 match in another league. This is far too little for one weekend. What you want is 10 to 15 matches for one weekend, and this means, at least 5 different leagues to diversify your risk.

Hello Charles,

Thanks for your very valid comment.

Consistency is the key. Stick to Pinnacle if it’s easier for you, or pick the highest odds from a selection of bookmakers. But don’t mix the two approaches.

As you are always looking to place bets at the highest prices available to you, then it is probably better to choose all the bookmakers you have accounts with. This will provide you with a more realistic picture.

Of course, the fewer games you analyse, the more margin for statistical error there is. If you are analysing five seasons’ worth in any league, then choosing just one bookmaker will usually suffice. If it’s a smaller sample size, say just one season, then a bigger pool of available data would be better – i.e. data from several bookmakers.

I hope this helps and good luck!

Hi!

When trying to calculate ratio bets, should one use odds from one site or can it be from different sites to get the best odds?

For ex. when looking for 0.78-0.84 ratio (Draw odds / Away odds), should I use the Draw and Away odds from Pinnacle, or should I use odds from two different sites if I get higher odds?

Hello again Betakos,

I am sorry but I do not really understand the question – What exactly do you mean by “How the home win % are different?”

Please explain in a little more detail to help me answer your query.

Many thanks.

Hi there ok lets just focus on why the mathematical inflection point for home favorites differs to the market one? What are the calculations for finding the markets inflection point?

Hi betakos,

the inflection points are the points where when betting on a specific result profits turn into losses, and vice versa. There are certain odds clusters in which bookmakers constantly reduce their prices to ensure profits, and other odds clusters, where the demand for bets is low, and therefore these prices are increased.

Sorry, I cannot explain in a few words how to calculate this. It’s a pretty complex topic.

If I understand correct we compare the mathematical inflection point of a league to a certain cluster of the league. I use your idea of clustering home odds/away odds. So lets say the mathematical point for premier league is 40% for home favorites and the 0,55 cluster inflection point is 55% how should I behave then

Ok i feel a little bit dummy. Could you explain why the mathematical inflection points differ to the markets?i can not follow on this. How the home win % are different ? We still have the same wins out of the total dont we?

Thanks in advance and keep it this way. Very good job

Your site is the most interesting and most valuable that I’ve seen until now after more than 10 years of betting … or trying to bet 😉

A must read!

Hi,

I have my Question: are calculations based on a Fixed win/risk Staking Plan or not?

Thank you

Hi Roman,

all calculations are based on a fixed risk (backing using the same stake) staking plan.

Hi,

This was a very informative piece. Can I just ask, in the graphic above, do the leagues match up as follows?

League 1 – Belgian Jupiler League

League 2 – German Bundesliga 1

League 3 – English Championship

League 4 – French Ligue 1

League 5 – English Premier League

League 6 – Dutch Eredivisie

League 7 – Scottish Premiership

Thank you

Sorry John… No, the leagues do not match up in this order.

Although this article is certainly a helpful educational piece for the public, it is mainly written for buyers of our HDA tables to help them to understand how to utilise the simulation tables to compile a winning portfolio…

Backing the underdog at home in some leagues is only one subset of a plethora of possible betting strategies.

At Soccerwidow we educate bettors in odds calculation and how to develop your own winning strategy. We strongly believe that it is crucial to understand the betting market and odds calculation in order to become a long-term winner.

Every bettor has his/her own preferences and therefore, it is simply impossible for us to provide picks or any ready-usable strategies applicable to a wide audience.

Hi, I enjoyed the article, I have been reading Soccerwidow for a while, and I would like to thank you very much for these instructive articles.

But I didn’t understand how the bets on favourites at home work. Could you please explain better?

I think I get it with the Home underdog. If the dog has a probability of winning of 22.77%, placing a bet at odds of 6.2 will have an expected value around 1 times the bet. Then, clearly if the odds are greater than 6.2, the expected pay will be large than the bet size.

But it seems that the same logic should work for the home favourite. If the favourite has 56.48% probability of winning, odds of 1.77 will make the expected received value to be 1 and anything above will be a profit. Why then, should we bet on favourites with odds BELOW 1.77?

Could you please explain?

Thank you.

Hi Alex, odds calculation and making profits from betting is a very, very complex matter. I’m sorry for your confusion, but there is no short answer to your question which I could provide here. I would have to dive deep into statistical analysis, distributions, etc.

However, I’m currently working on a 1×2 odds calculation course and many thanks for your question, I will remember to address it in depth in the course. Questions like yours help hugely to know what topics need to be addressed, explained and explored.

Great piece! I really enjoyed it and it has grabbed my interest even more than most of your work.

My only question is how you calculated the actual market inflection points in the EPL. You mentioned that the HDA simulations will help you but I’m not sure you fully explained how it is worked out. What data is used for you to get odds of 1.50 & 6.20?

Apologies if this was explained and I didn’t pick up on it.

Hi Matt,

Thanks for the praise 🙂

The tables this year have received a serious upgrade, and they calculate up and down the ladder (almost) every direction the user wants to explore. We are planning to publish a video which guides the process of identifying the inflection points in the HDA tables. Watch this space!

Hi Matt, I just uploaded the promised video on Youtube. An article to go with the video is in hand.