Stake Ratchet & Stop-loss Mechanisms

For the sake of providing a like-for-like comparison with the Summer League Campaign, we decided to incorporate the promised winter league ratchet and stop-loss mechanisms separately. (See Chrono tab).

Due to time and Excel limitations we can only show you this simulation based on an initial starting stake of 100 units. It should therefore be easy for you to extrapolate results for any other stake size you wish to analyse.

As you can see, the starting bank of the portfolio was just £2,000 and, as previously mentioned, £100 flat stakes were used.

This is just one example of a progressive staking plan; this one is perhaps a medium-aggressive approach. But feel free to use your own ideas.

Ratchet Rules

Here, the ratchet increments are +5% chunks of the initial starting stake (£100 in this case) for every whole £1,000 profit above zero.

The ratchet is triggered when profits reach at least £1,000 above the previous ratchet trigger point.

Therefore, the first trigger point is £1,000 above the starting figure of zero (i.e. anywhere in the range from £1,000 to £1,999.99).

Whatever the profit value is at the first trigger point, say £1,500, the second trigger point activates when the portfolio next reaches the end of a round (week) showing at least £2,500 profit (i.e. at least £1,000 above the previous trigger point).

If the second trigger is activated at, say £2,650, the third will trigger when profits next reach the end of a week at least £3,650 ahead, and so on.

At the £3,650 trigger point, the stakes will be 115% of their initial level. Thus, £115. (£3,650 contains three whole thousands @ +5% increment per mille = 15% increase).

If profits were £9,650 at the end of a week, the new week would begin with stakes set at 145% of the initial level (i.e. £145).

If there is a significant jump from one week to the next, the new stakes will always be calculated on the new profit figure regardless. If at the end of one week profits are £6,000 (stake at 130%), and by the end of the next they are £10,000, then the stake will increase from 130% to 150% in the following week.

Stop-loss Rules

The stop-loss is almost the same concept as the ratchet but in reverse.

Again, when checking the last complete week’s performance, the trigger will activate whenever the bank suffers a loss of £500 or above.

For each whole 500 unit loss, we step back the current stake level in -5% chunks.

For example, if the current stake is 125%, and the week just finished shows a £3,250 loss, then the stake is stepped back by -30% to 95%. (£3,250 contains six whole £500’s: Six -5% chunks are -30%).

The portfolio start day was a Friday, and weeks were therefore defined as Friday-Thursday. Results at the end of each Thursday were reviewed to see if a ratchet or stop-loss adjustment to the following day’s stakes was needed.

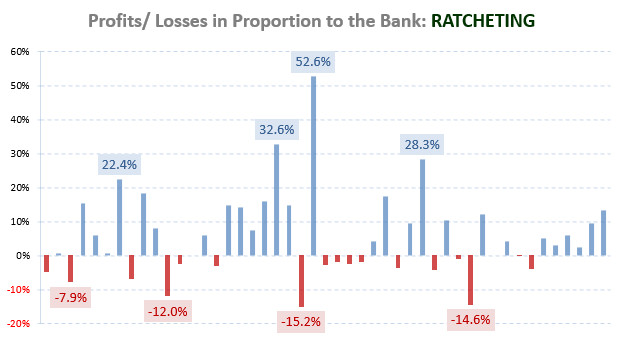

As you can see from the simulation, the progressive staking plan made a huge difference to profits. Despite a run of heavier losses towards the end of the campaign, the medium-aggressive approach produced a total profit figure of £27,787.60, more than £8,000 above the original £19,603.00.

In percentage terms, this is an increase of 41.75%. This is a massive amount and you should understand that it is generated purely by working the money already in the bank harder, thus increasing turnover.

The analysis showed that profits were likely to be somewhere between 0.74% and 21.37% (Summary tab cells L36 and M36).

If a portfolio is set-up in a well-balanced manner, and shows a likelihood for profits, then the more money thrown at the situation, the better. The ratchet and stop-loss mechanisms provide a professional and controlled approach to doing just that.

Increase the ratchet percentages for a more adventurous approach (higher risk strategy), or increase the stop-loss negative percentages for a more conservative approach (lower risk strategy).

Please note that this example of a progressive staking plan is tailored to this particular portfolio and is a simulation only.

For more detailed information regarding the relationship between winning and losing streaks and optimum size of starting banks in general, see our article The Science of Calculating Winning and Losing Streaks.

Summary

Looks good so far, doesn’t it?

But now it’s time for a stern reality check.

Looking objectively at the results it is clear to see the extent to which the portfolio underperformed:

-

- Hit Rate

At face value, the actual hit rate of 37.31% does not seem far adrift of the average hit rate mooted for the portfolio, which was 38.87%. However, the reality of this small difference is 28.5 fewer winning bets: 1,828 bets @ 38.87% hit rate = 710.5 winners versus the actual number of 682 winning bets.

The financial effects can be fairly estimated using a control, the most appropriate of which, is the harmonic mean odds. These were recorded at 2.98. (See Chrono tab, cell L1838).

28.5 winning bets all at odds of 2.98 would have equated to an additional profit of £5,643 (28.5 x 198), which in turn would have pushed the total profit for the portfolio to a figure of £25,246.

So, due to just a small hit rate deviation (1.56%), the actual profit figure of £19,603 was only 77.6% of the notional £25,246.

The small difference is therefore not so small at all: it ameliorated the bottom line by more than a fifth (22.4%) of what should have been won.

- Accumulative Ratios: Winning & Losing Streaks

In the Summary tab, you will find the benchmark for the winning and losing streaks in columns P and Q, whilst the results are in Y and Z. The accumulative highs recorded for 2011-16 were 134 for the winning streaks and 260 for the losing streaks. These figures represent the sum of the highest values experienced in each system over five full seasons.

Albeit not scientific, this does allow us to produce a ratio, which we have called the win-to-lose ratio.

The win-to-lose ratio provides us with a notional measure only of the power and accumulative effects of the losing streaks over the winning streaks.

Although in 2016-17, the damage caused by the losing streaks was less than the worst case scenario (215 vs. 260 = 82.69%), the power of the winning streaks to counter was also reduced (85 vs. 134 = 63.43%).

The maximum losing streaks were therefore less than 18% away from being at their predicted worst, whilst the winning streaks were over 36% away from being at their best.

The net effect was that the balance tipped further towards the losing streaks as they increased their ‘detrimental effect’ from 65.99% in the cold analysis (Summary tab cell Q40) to 71.67% in the field (cell Z40).

Although the numbers arguably mean nothing, they do allow us to feel how the portfolio was under more stress than had been expected. The maximum winning streaks were down further than the maximum losing streaks, and therefore the overall balance of power held by the losing streaks increased and caused more damage than anticipated.

- Reduced Yield

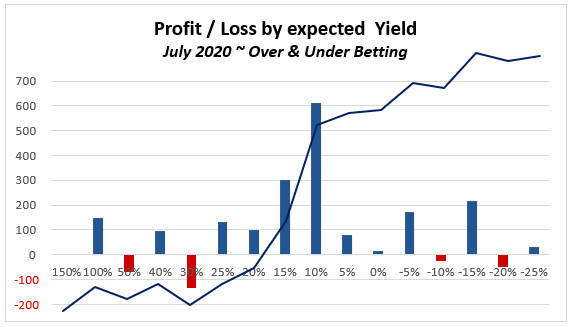

The combination of the two factors above had a detrimental effect on yield, which at 10.72%, was less than the 12.17% profited by the smaller 2016 Summer League programme (only 825 bets = 45% of the size of the Winter League Campaign).

- Zero Odds Increase

In the Summary tab, cells L1839-40 show that the break-even odds for the portfolio increased from 2.57 expected, to 2.68 actual, another sign that the portfolio performed worse than anticipated.

- Hit Rate

- Despite all of these failings, the bottom line was that this portfolio still made almost £20,000

- Add the concurrent Summer League Campaign results, and the total is just shy of £30,000

- Factor in a similar increase suggested by our ratchet and stop-loss staking plan, and the total becomes a few pounds over £42,000

- And all with relatively small stakes…

Final Words

This campaign has proved that profit size is directly influenced by both portfolio size and staking plan.

In simple terms, the larger the number of targeted value bets, the bigger the profits.

Even at a relatively modest yield of 10.72%, the higher number of bets (turnover) created almost double the profits of the 2016 Summer League Campaign, which finished with a higher yield of 12.17%.

The Summer League Campaign was therefore more efficient in converting turnover to profits, whilst the Winter League Campaign was more of a brute-force success, relying on the sheer numbers of bets.

Portfolio size is therefore a huge part of successful betting: the bookmaker business model is based around this very fact.

The 2016-17 analysis suggested a final profit figure of anywhere between £1,361 and £39,280. (Summary tab cells L35 & M35). At £19,603, it finished not far away from the equidistant point of £20,320.

The 2016 Summer League analysis suggested a profit of somewhere between £1,338 and £20,257. At £10,038, it was again not far from the equidistant point of £10,797.

If you are new to staking plans, hopefully the stake ratchet and stop-loss simulation will introduce new ways of tactical thinking and effective money management in a betting arena.

Money begets money, and it is a no-brainer to raise the ante with incremental ratchets in order to increase turnover. In any line of business, larger turnover means larger profits. The ratchet focuses on working the profits already banked in order to inflate the bottom line.

By contrast, the stop-loss mechanism is a ratchet in reverse, and acts like a tourniquet to stem a tide of losses. It prevents your bank (and your confidence) from being pummelled by the full effects of any bad run of results you may encounter.

Use a ratchet mechanism for adventure, and a stop-loss provision for insurance. Hoist up the stakes when all is fair and good, and don’t be afraid to haul them back in again during a storm.

Plan out the whole campaign, stay in control of it, and don’t waiver from the plan unless you’ve won more than is satisfactory…

…There is never any shame in quitting whilst ahead.

And talking of quitting, this will perhaps be the last review of a portfolio campaign we do for a while.

We are so sorry, but they are just so time-consuming to prepare and publish. And besides, we think we have already done enough to explain how to compile a portfolio and how to run one.

We have now written one review of a Summer League Campaign, and this one for a Winter League Campaign. Together, both reports should provide you with the tools to go off and do this for yourself. And besides, we feel that any future reviews would end up repeating a lot of what we have already reported. Just think of it as the law of diminishing returns in action…

Oh, and one last thing of great importance. Please do not use old analyses like this one, or out of date HDAFU tables to strike bets in a future season. Everything has to be re-calibrated at the end of a season, and things definitely do change according to the revised pool of historical statistics. Either the inflection points of a bet type will radically alter, or the bet type itself will become redundant to a better alternative. You may even see a change in the odds setting for a particular bet type in a league performed wholesale by the bookmakers to counter a strong trend of results.

And here’s another opportunity to obtain the 2016-17 Campaign Excel workbook for just £1.99 GBP:

>>> 2016-17 winter league campaign <<<

Remember, when buying this spreadsheet you will also receive a coupon code offering a discount of £7.00 GBP, redeemable against the purchase of any individual HDAFU Table. This allows you the opportunity to experiment and explore your first HDAFU Table without paying the full price for it and before you commit to buying more. Again, formulate strategies for any current season ‘on the cheap’!

Dear Soccerwidow, i’ve tried out inflection point graphs for U/O2.5 goals using HO/AO and HO/AO range of (0.095-0.237) gave me results which look good for Germany BL 1 2016-15 season when back tested because all games ended in O2.5 goals. I think may be I made a mistake some how. Can I email you the table I used to check it out?

It seems, Odoo, that I misunderstood your previous question as you placed in an HDAFU Table article but referring to the Cluster Tables. Please ask any further questions re. Cluster Tables in the FAQ article: Frequently Asked Questions – Over Under Cluster Tables

In answer to your question… Do you know this article here? What are Inflection Points and their Use in System Betting It will probably provide you with the answer you’re looking for.

To answer your query shortly: No, it’s pretty unlikely that you made a mistake. Bookmakers adjust odds according to market pressure and expectations. So, if your backtesting shows good results then the future is likely to bring good results too. Just be very careful and adhere to a strict staking plan.

Dear Soccer widow, is it possible to get systems from HDAFU simulation table using quartiles in the IPHOAO section?

Dear Odoo, you can certainly try but to be honest, I do not know. This particular scenario I have not analysed and, therefore, I cannot say if it works or not. Sorry.

The Inflectionpoint HDAFU tables provide such a plethora of information and different angles that the quartile approach may be well worthwhile to explore.

Have a very Happy Xmas and good luck with your betting!

Hi? I’ve purchased the 2011-16 winter league campaign. I want to know how you compute the odds rank* column.

Hi Odoo,

Firstly, Excel can only cope with 200 markers for a graph.

The Inflection Points graph in your spreadsheet is powered by data from the Odds Rank column.

If you sort the data (rows 6:1833) by the odds column L (smallest to largest), you will see that the odds rank numbers in column B then line-up in batches from 1-200.

To assign the 200 groups of numbers it is merely a case of dividing the total number of data sets by 200. In this case, 1,828 matches divided by 200 provides roughly nine matches per batch (rank).

I hope this answers your question and helps you to understand how Excel graphs work.

Thanks for your question and all the best for now!

Dear Elena and Rob,

I hope you are doing well! 🙂 if I may ask you the following: which odds have you been using for your 2016/2017 winter leagues excel sheets? I have tried to reproduce your portfolio for the French Ligue 1 on the paper backing the favorite. However the odds ive been using slightly differ from yours and interestingly this small difference eventually makes a big difference. My result is 904 units compared to your 1.634 units. As the odds decide which game you bet we have a different portfolio (your portfolio consists of 138 matches in France, mine has 131). I would like to reproduce your portfolio but would need to know the exact odds you were using.

My odds: I used historical data from football-data.co.uk. For whatever reason their excel sheet does not contain maxodds at the market.)

So I took Bet365 Interwetten, BWin, Ladbrokes, Pinnacle, William Hill, VC Bet and Pinnacle closing odds (last odds before match starts). That’s all the odds I got from the excel sheet from football-data.co.uk. for the French Ligue 1 2016/2017 season.

Now, which odds exactly have you been using? My guess is that you have been using the highest odds available on the market at kickoff. But where do you get the data from?

Last question: do you know any other website that provides historical odds in excel sheets?

Thank you and warm greetings to Teneriffe!

Florian

Hi Florian,

Yes, we are both fine, thanks very much for asking – I am back in the UK these days whilst Elena continues to bask in the warmth of Tenerife (lucky girl!) 🙂

2016-17? Seems almost an aeon away now! If I remember rightly, Australia A-League, EPL and Greece Super League were all based on audited Oddsportal odds at the point of kick-off, where manual adjustments had been made according to the timestamps on each set of match odds. They were as accurate as we could get them.

The other Winter Leagues used unaudited Oddsportal odds (i.e. scraped as they appeared), again at the close of the ante-post market.

The range of bookmakers we used is outlined in our article about the settings in Oddsportal.

One thing I will say is that when revisiting Oddsportal after more than three seasons (bearing in mind the odds used for 2016-17 were for the seasons 2011-16), what you will find now is not going to be the same picture. Oddsportal odds have a habit of being distorted by bookmakers that were in the portfolio in 2016, for example, but which have since been discarded as a featured bookmaker for whatever reason.

In other words, I have found in the past that things get churned around to some small degree every year making it nigh on impossible to replicate the same results when scraping odds from Oddsportal. Of course, the first set of odds used for each table, 2011-12 (seven seasons back now), will probably be worse than the other seasons, and so on down the line in varying degrees.

To be honest with you, I think you’re likely to be fighting a losing battle if you are trying to replicate a past portfolio.

The newer home odds divided by away odds ratio approach to system building and match selection has shifted the emphasis away from purely looking at match odds to determine cluster groups. Indeed, the relationship between the home and away odds is a far more accurate benchmark, which doesn’t tend to change radically during the ante-post market.

In answer to your second question, apart from Football-data.co.uk’s free Excel sheets, the only other source of odds that I am aware of is a paid service courtesy of Football-bet-data.com.

Florian, I hope these answers help you in some small way and thanks once again for taking the time and trouble to contact us.

All the best for now.

Dear all,

I have seen so many of you experiencing different runs of fortune this season; many of you communicate with me via private mail and many of you post your experiences on the blog. Firstly, therefore, thank you for even bothering with our website. We are always very humbled by the support.

Although I can’t share anyone’s individual paths, what I can say is that the raft of results vary from exceptional (several better than our own) all the way through to pretty disastrous.

This range of results is of course down to the following facts:

1) No two portfolios are exactly the same

2) Bet selection criteria may differ from person to person during the ante post period

3) Each person will certainly have different bookmakers at his/her disposal

4) Bets will be placed at different times and/or at different odds

In addition to these fundamental differences there are many more variables such as missed bet opportunities, lack of consistency with the timings of bets, and personal traits such as greed in waiting for higher prices to appear before committing to the bet, or even hesitancy in not being confident enough to place the bets because ‘common sense’ dictates otherwise.

Whatever the differences between you all, whilst it is nice to encourage each other when things are going well and commiserate when things are failing, please all be aware that you are indeed all different. When you begin to compare results with each other, please, please always have in the back of your mind that your are effectively comparing apples with pears, and don’t draw too many conclusions from someone else’s experiences.

Your results and, more importantly, how you come by them, will bear little resemblance to each other. This is important to remember, and appreciating this fact will go a long way to understanding that ‘herd mentality’ is exactly what the bookmakers thrive on.

I do feel genuinely very sorry and remorseful for those who have bad weeks, and happy (and sometimes even justified!) when reports are received of roaring successes. And like a standard distribution curve, we receive equal numbers of both.

Personally speaking, we have been using this systematic betting approach for several years in both full-term market and in-play trading scenarios.

The three most important elements are:

a) Size matters! The larger portfolio the better.

b) Portfolio balance matters! A balanced range of bets from low-low/medium-medium-medium/high-high is essential.

c) Bank roll management is crucial. protect what you have and speculate when you can.

Perfecting the other necessary cosmetic details such as identifying bet placements, persevering through crises, monitoring results, checking everything, adjusting attitudes, and so on, is a very personal thing. I can tell you that what works for one will be unpalatable to another. You must find your own balances here.

And lastly, there are two types of mistakes: good mistakes (lucky wins), and bad mistakes (uneducated losses). But you must always be in a position to recognise mistakes (whether good or bad) as mistakes whenever you make them. Write them down. Post them in front of your screen. And try very hard not to repeat them.

I hope this helps.

Hi guys,

Quick update on my paper testing of the remainder of my campaign. The 2nd half systems have had a few rounds to get going, and with the results in, to date the overall picture for the entire campaign is as follows:

Total profit based on £100 stakes = £2414.90 (Which is 24.14 points of profit)

Overall hit rate is 36.05%. Expected is 44%

Yield = 2.74%. Expected is 26.43%

So as it stands, even though the performance is below the average of the last 5 seasons, the whole thing is in profit.

I regret not sticking with this and carrying on placing bets, as if I had done so, I would have recouped losses and got back in profit. Live and learn as they say.

Still, a lot can happen, this season from now until the end. But I just wanted to report the period of success and to say that long term, this is working out as planned.

Summer leagues start this weekend with Ireland, so I plan to begin a fresh campaign with real wagers then.

Good luck guys.

After a glimpse of hope at the end of 1st half that statistics finally settled in and recovering from losses well, I finished my 6th losing week in a row today. The hit rate was 16%. I sincerely hope I will stop chasing Simon’s “achievement” of 11 losing weeks in a row now. The campaign came back to its usual performance: 1, maximum 2 wins and then normally a losing streak of at least 4 bets, but just 4 is like a dream, normally it’s 5-12. When portfolio performs like this, no bank management will save your bank, it will just go bust later. When balance goes up, ratchet-stop loss mechanism should work well to get the most out of what you do, but when it goes down, I find it detrimental. You may bet 100 units, suffer losses, then reduce the stake to say 90, and if you win, you recover from losses by betting just 90 units, not 100. Then, if you’re lucky to win enough, you increase your stakes again to 95 or whatever and then you lose again at those higher stakes. It complicates recovery of a bank. I ran simulations and that’s exactly what is going on when portfolio fails to perform how it should for prolonged periods of time and the way losing weeks exchange with winning ones. It has 4 months to go, 5 months are gone, 785 or 60% bets placed out of 1307 estimated. I won just 224 or 28.54% of my bets. Expected hit rate is 40.93%. The hit rate is lower by 12.39%. With this kind of deviation against me, portfolio is going to fail and ratchet-stop loss mechanism would make it fail even worse. Even though it’s really unlikely all strategies will fail, it’s little consolation for us. It doesn’t matter if all systems fail and lose 10000, or 9 systems win 10000 and the 10th system lose 20000 units. It’s incredibly tough to cope with after successful summer season.

It’s weird because I’ve found the opposite has happened. Mine has actually started (I hope!) to settle in to normal performance. I’ve had a few strategy changes as we’ve moved into H2 of the season, but even some of the strategies which were catastrophic in H1 have now sorted their lives out and are making money.

January brought 28.5 points worth of profit – a pretty crazy month! I’m prepared for more variance between now and the end of the season, but hopefully on a more measured basis than we saw in the first half of the season.

Jo,

Please don’t replicate my run of 11 losing weeks in a row! That was most certainly a brutal run of bets.

After the 11 week losing run, I stopped placing real bets and went into observation mode, but as my luck would have it, the entire portfolio recovered and ended the 1st half of the season in profit. Not a fortune, but 12 times the stake size, so it was something.

As for now I’m just paper testing the remainder of the winter leagues and seeing what happens, and using it as a learning experience. I hope yours is profitable for you.

You raised the point about the ratchet and stop loss mechanism. In my winter campaign I did eventually employ a stop loss, but not right away. Having said that, I kept 2 separate records: 1) Flat stakes for every bet, 2) Reduced stakes via stop loss.

Interestingly there was not much difference at all in the bottom line when comparing both methods of staking. I’m basing that on losing less per losing bet, but winning less per winning went, so balancing out somewhat. Definitely the ratchet is great when on a long winning run as you really can make the most of winning bets with larger stakes. Its the long and protracted losing streaks that will be detrimental. Winnings will disappear fast with larger stakes.

The effect of my losing streak on the bottom line of profit/loss was mitigated by the fact that the losing run occurred at the point when I had accrued 24 points of profit. After 11 weeks of losing I was at -30 points of profit. So that’s a 54 point swing, and in isolation, half of the bankroll. In real terms 30% of the bankroll.

I mentioned it before in a post of mine, that my belief is that if the system or group of systems are all viable, then flat staking will produce a profit. My system’s showed that to be the case after judging at the end of the betting period. It’s a shame that 2 of the 13 systems running (Spain, Turkey) suffered “Heavy” losses and really dented the final profit figure.

Certainly for the 1st half of the season, there were bigger than expected deviations in the hit rate of some systems – which most of us have reported.

I’m hoping the summer campaigns show a little more consistency!

I am almost pulling the plug after another DISATROUS week in which I lost more than 15 stakes! I have no more spare money to throw into this hopeless thing. Months of hard work flushed down the toilet in a matter of days is more than I can take! And SIMON, can you please mail me the exact odds ranges and possibly all the matches you have bet on the following systems:

Ligue 1 (Favourite) +515

Bundesliga (Underdog) +760

Ekstraklasa (Underdog) +1293

Ligue 2 (Draw) -223

I also have these and they are all at pretty big loss. How can this be?

Rado,

Yes, no problem, I will get in touch with you on Monday.

I noticed a while ago that if some of us make profit, then some of us suffer losses. With probably none of us achieving any gains in profits in the long run. This weekend I finally broke my 6 weeks losing run and had a good weekend. 10 bets won out of 24, 41.66% hit rate. Even if all estimated bets lose up to Thursday I will still be in profit. However, it seems even with the supposed advantage against bookies not all of us will avoid portfolio failure. Having endured so much, it’s pain to read about someone else having another disastrous weekend. Scott, let us know how this weekend went for you? And Simon?

I suffered small loss in Ligue 1 favourite, 1st half, Ekstraklasa dog, 1st half was pretty much the same profit as Simon’s.

Rado, it’s strange you suffered loss in Ekstraklasa since it was very good performer with dogs, maybe it’s because the way you decide if the bet is valid or not?

Although my difference with Simon’s Ligue 1 favourite is very big – about 700 units. 99% of time I rely on pinnacle odds only and I check them on pinnacle site, not oddsportal. If the odds fall in the range, then I check other bookies for even higher odds and then place bets.

Hi Jo – I had another good weekend. 8 points of profit. It started off poorly with Friday and Saturday both making a loss, but came storming back on Sunday.

Belgian and Austrian draws both had a good weekend as did Italian favourites.

Last minute drama in Monaco was a nice way to finish the weekend!

I am completely devastated! After accumulating a nice profit in the last 2 months, the last 2 weeks destroyed everything. Over 20 stake units loss! All my profit is gone and now I am below zero balance… NONE of my last 10 bets won, and these were not only high odds, but also short priced favourite games… I don’t understand how can this be possible. About 80% of all my systems are 10-15% below the projected hitrate!!! Why?

Rado,

As you can see below from my results posted, in the 1st half of the season, I had some systems performing well, and some that were catastrophic and really dented the potential profits.

I only had one system that I would classify as an over achiever – where the hit rate was way over what was expected. From looking at the hit rates of the achievers and zero sum systems, they were well below the average of the last 5 seasons.

I think the low hit rates has really been the consistent factor that everyone has reported on that is stunting our gains. Nothing we can do to affect the results on the pitch, and we can’t stop a poor patch of results all coming at the same time.

As mentioned I stopped placing real wagers at the start of November, and carried on paper testing. Many of my systems that were losing – remember I had 11 losing weeks in a row! – recovered in the final 2 months of the 1st half season. So it seems we can either have consistent results or long periods of good and bad, which will result in a very topsy turvy season. Rado, I had multiple losing streaks of 8,9,10 losses in a row and it was very disheartening to see the bank depleted. Sometimes I would have an 8 game losing streak, 1 win, and then 8 or 9 losses again….it is tough to handle for sure.

I would much rather prefer a consistent run of results over a longer period of time rather than the topsy turvy nature of things many of us have seen….but that is not something we can control.

Observing results and paper testing is much easier on the nerves for me at present, as this was my first time getting involved with something more in depth. What I have learned is that things can only be judged at the end of the specified betting period and until that time, managing the bankroll is the key thing.

I lost money by getting panicked around november – when in hindsight I should have stuck it out and persevered. That was a valuable lesson learned for me.

I will post a complete hitrate report for all 17 of my systems when the season is over. Then we will be able to analyze everything.