The Numbers Game

Between 2006-2011, if you had gambled unemotionally and systematically on all English Premier League matches to be home wins and placed a constant stake of 10 € per fixture, then at the end of the fifth season, your winnings would have totalled 1,328.66 €.

That’s equivalent to an interest rate of 6.99% on the capital expended (turnover: 1,900 bets @ 10 € each = 19,000 €; 1,328.66 € is 6.99% of 19,000 €), more than double the rate of the best savings account currently on offer in the UK (times have changed since!).

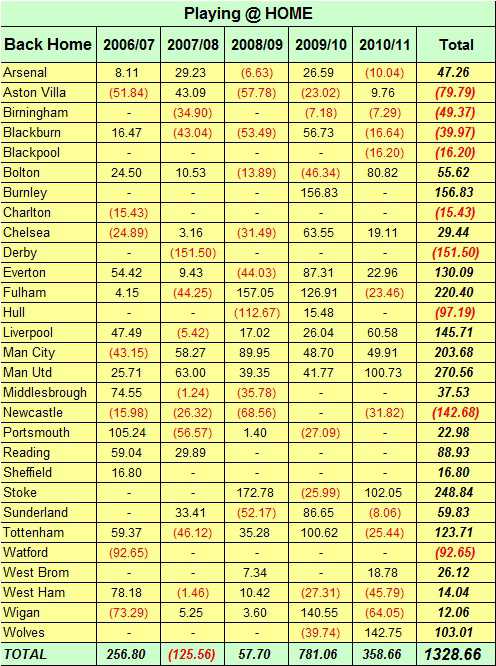

The table below summarises the home record of every team involved in the Premier League during seasons 2006-2011, and shows the end totals from a constant staking plan of 10 units per match:

To reiterate, a bet of 10 units placed on each of the 380 ‘home’ games in a Premier League season, with no omissions, would have resulted in a handsome profit over the five seasons analysed, no matter how the results predicted beforehand (i.e. the odds) were perceived.

It places no reliance upon team news, injuries, form of the teams involved, or any other extraneous factor surrounding the games in question. It’s a quick and easy method to follow just so long as you can guarantee being able to bet on every match for five entire seasons, a total of 1,900 bets (assuming no matches are abandoned and/or replayed).

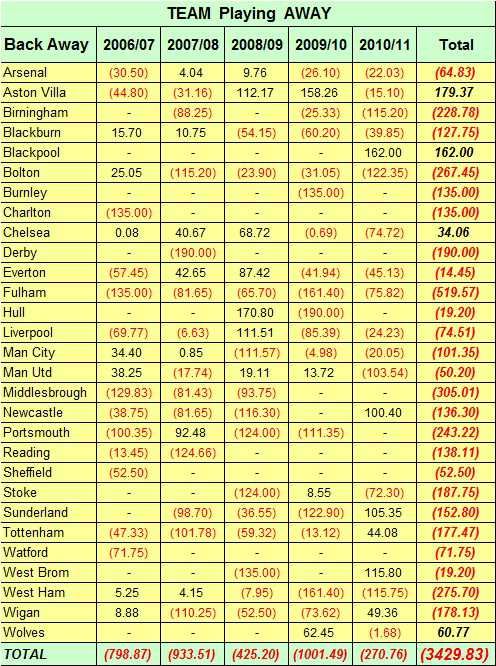

On the other side of the coin, if you followed the same strategy backing the ‘away’ teams to win every game, then 3,428.83 € would have been lost!

Some illustrations from the two tables: If you chose to refine your strategy and bet only on Tottenham to win every match at home, using a fixed stake of 10 € would have yielded profits of 123.71 € over five years.

However, a strategy of backing Tottenham to win every match away from home would have resulted in a loss of 177.47 €. In the same period, Fulham would have brought a profit of 220.40 € to win every home game, but a loss of 519.57 € backing them away from home.

These tables suggest that it is unwise to bet on any team in the English Premier League to win away from home on a consistent basis.

This is due to a combination of unpredictability in this league where ‘upsets’ happen on a regular basis, and the fact that the odds set by bookmakers and betting exchanges for these games seem not to afford the opportunity of long-term profits (value) for the bettor.

All of the tabular calculations have been based on ‘real’ odds exactly as they were found in the market (Ladbrokes). The losses in the above table indicate that the odds offered for away wins seem to be constantly too short or under-priced considering that on average, only 25% of matches in the English Premier League finish in victories for the away team.

Image: Symbiot (Shutterstock)

Image: Symbiot (Shutterstock)At this stage we do not have a concrete explanation for this obvious discrepancy in the bookmaker/market odds calculations between home and away prices. The only reason we venture to suggest is that away match prices are perhaps a good mechanism for bookmakers to achieve some form of guaranteed income?

Before beginning this evaluation, our theory was that the results would be relatively balanced between betting on home, draw or away results and that the bettor should theoretically break-even (i.e. the bookmakers wouldn’t allow a significant profit margin to be made from any of these markets).

Is there a formula to place bet on all three option and win (whatever happens) Home – Draw – Away

Hi Adam,

if you are referring to arbing/dutching, here’s an article on that topic: Dutching – Ausnutzen von Underround (Backen) & Overround (Layen)

Unfortunately, it’s in German only, so you will have to use Google.Translate to understand it. Sorry! However, I tried hard to write in short sentences so that an automated translation is still understandable.

Have fun! 🙂

Hello Soccerwidow!

I would like to ask that if I calulcate the percentage of draws in 5 seasons of data and for example it’s average is 27, with a standard deviation of 3 % , I have to calculate the average odds for theese events to know that if this is profitable or not?

for example:

24 to 30 % draws percentage

bookmakers are offered for theese events an average of 2,85 odds (35%)

This means that betting always on draws, can bring us profit?

Thanks

Hi sarkec, this isn’t a question which is a straight forward answer. Sorry!

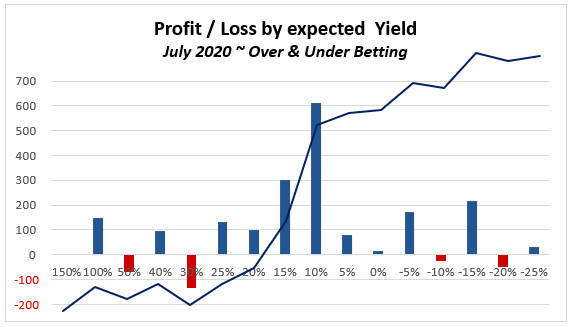

If you wish to work out a Back or Lay the Draw strategy you will need to get a few HDAFU table. There you will find inflection point graphs which help to identify the odds clusters which are long-term profitable.

If it’s guaranteed, why not increase the bank to maximise profit ie £2000 bank, £400 stake a game?

Hi Ethan,

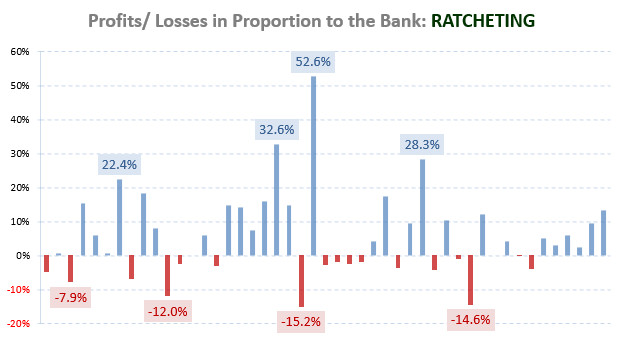

Succesfull betting is not about maximising profits but about managing risk. You may find this article useful: The Science of Calculating Winning and Losing Streaks

Hi Sander,

Ladbrokes is a middle of the road bookmaker and we were attempting to simulate betting exchange odds hence the 10% mark-up on Ladbrokes’ odds (see picture captions).

Hope this helps.

But is assuming 10% on top of Ladbrokes odds not way too much? F.e. if home has an odd of 1.70, no other bookie will have odds of 1.87. So this is definitely a game changer.