A Beautiful Mind

Introduction to Combinatorics and Probability Theory

This article is a step-by-step guide explaining how to compute the probability that, for example, exactly 4 out of 6 picks win, or how to calculate the likelihood that at least 4 of 6 bets win.

To help your understanding of this topic you will need to comprehend the basics of football result probability calculations, which I explained in detail in the article Calculation of Odds: Probability and Deviation.

The Basics of Probability Computation in Football Betting

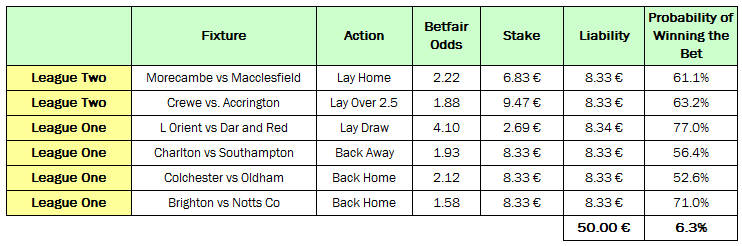

The following picks table contains 6 value bets including the calculated probabilities for each bet to win:

Of the 6 published picks, 4 won and made a profit of 19.9% on the 50.00 € betting bank. I will now attempt to explain the mathematics behind the above selections.

The calculation of the probability that all 6 Picks will win is relatively easy and requires no knowledge of difficult formulas. You simply multiply together the given probabilities, thus:

The result of 6.3% is the probability that all 6 picks in the portfolio win.

Of course, the other end of the scale is that all 6 picks will lose. Again, this is a straight forward calculation: simply multiply the opposing probabilities to those used in the ‘win’ scenario, thus:

The result of 0.1973% is the probability that all 6 picks lose.

Summary:

- Probability that all 6 Picks win: 6.3%

- Probability that all 6 Picks lose: 0.1973%

If you divide 6.3% by 0.1973% the result is 31.93. This means the probability in this particular portfolio that all 6 picks win is almost 32 times higher than the probability that all 6 picks lose.

Practically speaking, there is a 32 times higher chance of winning all 6 bets and cashing 40.90 € profit than losing all 6 bets together with the entire 50.00 € starting bank.

Accumulated Betting Odds

- To win all 6 picks: 15.9 (1 divided by 6.3%)

- To lose all 6 picks: 506.7 (1 divided by 0.1973%)

These odds express that on average all 6 selected bets should win once in every 16 rounds and only once every 507th round should a total loss of the portfolio occur.

A single season’s football league betting will usually comprise approximately 80 rounds of matches (midweek and weekend betting). This means that statistically a total loss may happen once every 6.3 years betting on a similar portfolio to the example above each time. Of course, it could happen more often as wins and losses have a nasty habit of not lining up as cleanly as statistical theory says they should. For example, 2 total losses could occur in the first 2.6 years and then no more for another 10 years.

What is the probability that exactly ‘X’ picks win or lose?

Further interesting questions include what are the probabilities that exactly 5 of the selected 6 picks win, or at least 4 of the picks win, and following this, it is natural to ask whether it is viable to make long-term profit on this type of portfolio and if so, how much?

An easy starting point for assessing whether a portfolio is ‘worthwhile’ is by calculating the ‘expectancy’, in other words, how many of the picks are likely to win. This is simply the average of the win probabilities of the selected picks:

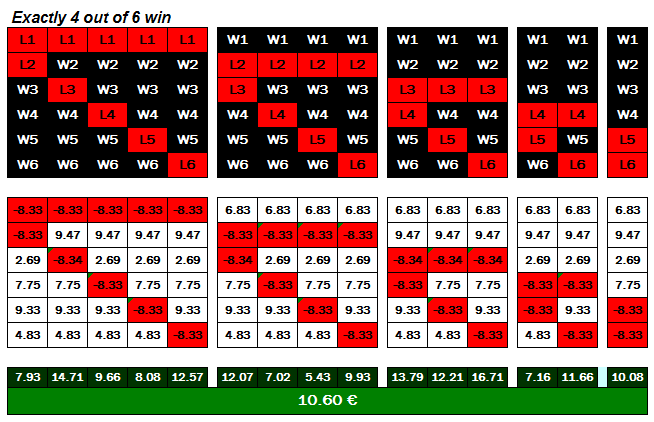

This value means that by betting on the above portfolio a success rate of 63.55% is ‘expected’, which would correspond to a hit rate of 4 from 6 picks (i.e. 6 [picks] times 63.55% = 3.81 [roughly 4 picks]). This means that on average this portfolio should usually bring around 4 successful picks. However, it is obviously necessary to check if the combination of 4 successful picks and 2 failed ones will produce a profit:

The above illustration shows that every combination of 4 picks from our 6-match portfolio would have returned a profit of between 7.02 € and 16.71 € depending upon the combination.

Important Note

Please note that the average value (expectancy value) does not mean a 63.55% probability that exactly 4 picks will win every betting round. The average value indicates that if you bet on this type of 6-match portfolio often enough, an ‘average’ of 4 hits can be expected.

hi,

congratulations for the post, I know if it is possible how do you calculate to get a 61.1% chance to win the bet?

I can not understand how to calculate these values.

Thank you

Hi Paul, spend some time reading the website.

There are many articles which address probability calculation. Also use the the search box (top right). Then you will find lots of related articles to your search.

I did one for you. Check it out here: calculate winning probability

This article is nonsense. Betfair prices are notoriously efficient so if the BF price is 2 then the probability is 50% not some exaggerated probability that you have invented to try and prove that your system works.

If you can show me a way of guaranteeing a 55% probability on a price of 2.0 then I would be more than interested.

Hi Marc, I’m not ‘inventing’ anything. I’m just explaining maths and statistics and their application to betting.

Until October 2012 I was a regular author for the Betfair blog in Germany (until Betfair moved away from Germany due to change of gambling law). Further, I was regularly publishing overviews, analysis and statistical explanations for my published picks for Betfair: Soccerwidow’s Value Betting Results: 274 Bets, from 07/12/2011 to 30/06/2012

Betting is not easy, and there is (and never will be) a ‘guaranteed’ strategy. Without proper understanding of odds calculation and statistics the bettor has no chance.

There is a reason why bookmakers employ odds compilers and statisticians, and pay them high wages. Bookies would certainly save themselves these expenses if there would be any other way to come up with betting odds and make a profit.

Hi great post 🙂

A quick Q

If you had a program that assigns a (+-) goal advantage to the home team how would you get fair odds from this info.?

LETS SAY…

TEAM A should beat TEAM B by 0.5 goals, I can not think of a fair way to price up with this known info. I tried to work backwards from bookmakers handicap odds but i cant work it out or even get close. Im sure there is a basic formula that would give a rough estimate. STUCK PLEASE HELP…

Hi Scott,

I have developed a True Odds & Value Detector to calculate probabilities and therefore price true odds for League Games with H2H History. The calculations return probability projections within a variance of only 2-3% which, I think you would agree is accurate enough.

Mathematically speaking, neither ‘goal advantage’ nor ‘home advantage’ are arithmetical terms with meaningful quantitative data which can be analysed and used for calculations. There is a tutorial addressing this issue: Correct Assignment of Football Data to Levels of Measurement.

I hope this helps.

Best regards, Soccerwidow

Great post. I used to be checking continuously this blog and I’m impressed! Very helpful information specifically the closing phase 🙂 I take care of such info a lot. I was looking for this certain information for a long time. Thanks and best of luck.

OK, my bad. I missed the “Action” column.

Lay 4.1 is indeed equivalent to 1.32 back, very close to your probabilities.

Sorry for the confusion and thanks for your time.

Hey soccerwidow.I really like this post but I have a lot of questions for you.First I want to ask you about the action you choosed.You picked LAY HOME at Morecambe vs Macclesfied but at combined bets you can’t choose lay only fixed odds.Next you staked 8.33 euro for every team but there are a lot of combinations and the amount of 50 euros is overpassed.Another question is that all the tables give a proffit but if you play combined not every combination gives you a proffit so the tables give you wrong informations about the winnings.I would really appreciate if you can answer my questions!Thanks!

Hi John,

this article is intended purely as an example to make a point.

You can chose fixed odds for laying using betting exchanges or finding a combination of back bets with traditional bookmakers. For example: When to Back Instead of Lay Betting: Asian Handicap; Double Chance; Dutching…

Ok.I got it.But how about the stake cuz for example if you win a 4/6 combination you don’t loose 8.33+8.33 like in the example…

Hi John,

it’s about the probabililities to win the lay bets. The market odds may be totally different, and you are looking on long term profits.

You are right, in the example if you win a 4/6 combination you don’t loose 8.33+8.33, but this topic goes far beyond this article.

Sorry for coming back again 🙂 but after more carefully reading the article I realised that you’re using value bets which naturally skew the probabilities.

If the odds in your example were real values the success rate would be 56.83% and the distribution would also be affected, producing (very probably) even game in the long run.

Basically it doesn’t matter if one makes such a portfolio of several bets or make individual bets, except for diversifying, where a portfolio helps against long negative streaks.

Also if using a portfolio/set of bets, isn’t it a better idea to use “dutching” instead of the same stake/liability for every bet?

In that way one is not concerned about different winning/losing combinations, but only with number of winning/losing bets, (where each bet produces exactly the same outcome).

In short it is not surprising that the value bets produce positive outcome, one can use them in any way he wants.

To dutch the bets within the portfolio is an interesting idea. I haven’t thought about this yet.

However, I would think that this would require a portfolio which contains same probability bets only, and the same number of bets each round. Otherwise there would be a lot of confusion and stakes would be unequal. This would increase the risk of the bank being hit by a losing run. But this is an educated guess. I don’t know for sure.

Otherwise, you are of course correct. Having value on your side, it really doesn’t matter how you use the selections and mix them – They will always produce a positive outcome on the long run.

Hi,

I too noticed rather strange probability/odds ratio in your example, especially #3 odd of 4.1 with your calculated winnig probability of 77%.

Could you elaborate this a bit further?

Thanks.

The last column in the table contains the (own) calculated probabilities to win the lay bet, not the converted Betfair odds into probabilities.

Lets say u have a system with 70% probability and every single matches odd is 3. Then the expectancy is 2.1. If u play 10 matches every weekend and lest say the probability of winning each match is also 70%, although the overrounds are big, maybe it is more profitable not to play them single, but in combinations and try to find the best combination which gives the best outcome to the system. This is what i am trying to do, as everybody says play singles, but i havent seen anywhere why, apart from the overrounds, but i think if the odds are big like what i have described above, i think that a system betting on triples or quadriples or so, may be more profitable. I am searching myself for the right math to evaluate this, but as i see, u didnt do any research yourself on this subject, did u?

Just calculate it through and do a simulation. You will see by yourself that singles are the way to go.

Great work Soccerwidow, thank you for sharing all this work with us. I have a question though. If you want to play these six matches in doubles, triples and quadriples wouldnt the system be more profitable, if u do the math? Like asking for all triples and quadriples out of the six.

Just calculate your theory through and then write an article summarising your results. This would be really great!!

Although, because of bookmakers’ overrounds I wouldn’t think that any doubles, triples and quadriples make any system be more profitable. A system has to be working in itself, meaning with singles only.

Oh that makes sense then. I was struggling with how you had converted from the Betfair.odds. I have been studying an Open University statistics course and the idea of binomial probability distributions and combinatorics are of great interest to me. The theory you have outlined is excellent for a newbie like me and I will be paper testing some of these ideas over the next EPL season.

Andy

PS Thanks for your swift reply!

If you are a newbie you may consider buying our course: Football Betting Odds Calculation Course – How to Calculate Odds – Over / Under ‘X’ Goals. There you will learn a lot about odds calculation, probabilities, etc..

Hi, this is a great article but I’m a bit confused over the probability calculations. In the first graphic showing Morecambe vs Macclesfield how did you get a probability of 61.1% from lay odds of 2.22?

Your site is superb!

Andy

Hi Andy, the shown probabilities are own computations. They do not necessarily correspond with Betfair odds. This is where ‘value’ comes in, if you achieve to get a mathematical advantage over the market prices.

Dear Panos,

You do not have to be a maths genius, but it is important to get the mathematical advantage onto your side (a casino does this by having a green zero on its roulette wheel, for example). Unfortunately, ensuring this mathematical edge is the only way to make money from betting, there is no other option other than being very, very lucky all of the time!

Successful strategies involve fairly large portfolios of bets which means spreading risks between at least 50 to 100 games per round, and sticking to a disciplined staking plan. To publish this amount of tips perhaps 2 or 3 times per week is unfortunately too time consuming and obviously creates work in addition to all the necessary mathematical calculations behind identifying the picks. I need to remain sane and keep some time for other things! Placing this number of bets with the betting exchanges and bookmakers can also sometimes take a couple of hours.

So, no, you do not need a degree in maths but Excel competence and understanding of odds calculation is essential. However, if there is a need for betting seminars and courses I am available for booking – just drop me an email.

Hi , i’ve a question , people who have profit on betting like you , can you tell me what kind of mathematics and software use you? is enoug with excel or need i be an big expert in mathematics and software programming?

So , i need to learn this: http://en.wikipedia.org/wiki/Probability_theory and http://en.wikipedia.org/wiki/Statistical_association_football_predictions to earn money in betting??

its very difficult , it will take 10 years to learn it for me . maybe is better paying a software or follow some betting forums with some profitable strategy , (the main problem is the tipser dissapear many times in some months, usually when the strategy is very good).

Hi Soccerwidow,

I have a question about 1×2 betting in soccer.

Lets suppose there is a match between Team A and Team B.

Lets suppose the average odds are 1.28 5.54 10.43

And also lets suppose there are 100 games with these odds.

Now if there is a payout of lets say 95% in this case does it from mathematical point of view mean that if I were to bet on any of the 3 outcomes 1 unit, then after all 100 games I would have lost 5 units? I mean if I bet 100 times on team A, 100 times on the draw and 100 times on Team B, does that 95% payout refer to all 3 outcomes equally or lets say for favorite there is more payout or the other way around?

Thanks for answer.

Hi Raymond,

If I understand your question right you are assuming that the market odds represent the true probabilities of the outcome. If this would be so, then you could randomly bet on any outcome, and after thousand of matches only lose the overround.

Unfortunately, this is not the way the bookmaker market works. The overround is the bookies’ margin to guarantee a long term profit. For the gambler, if you accidental keep choosing the bets whose odds have been artificially reduced by the bookmakers to reduce their risk, your long-term losses would be much higher than the overround of 5% only.

Unfortunately, I cannot reply to your question in any greater length, but I will try to come up with an article which looks a little bit deeper into this issue.

Thanks for your question and interest in Soccerwidow.